One trade at a time. No grid. Built for disciplined Gold execution.

30 Day Money Back Guarantee

Apex11 Was Built for Traders Who Are Tired of Watching “Good Systems” Fall Apart

Gold is not a “hold and pray” market.

It moves fast.

Apex11 was built for that reality.

It doesn’t trade all day.

When volatility expands and a short-term trend starts to form, Apex11 gets involved — with the move, not against it.

No counter-trend guessing.

Once in a trade, Apex11 behaves like an experienced Gold trader would.

It watches price closely.

If conditions change, it doesn’t argue.

Because anyone who’s traded Gold long enough knows this:

The fastest way to give profits back

Apex11 is designed for fast, decisive execution — getting in when the opportunity is there, and

stepping aside when it isn’t.

Behind the scenes, it uses internal scoring and market condition checks to sense when short-term momentum is shifting, combined with professional-style stop logic built specifically for volatile instruments like XAUUSD.

Not wide, careless stops.

Just structured exits that respect how Gold actually behaves.

The goal isn’t to trade more.

That’s why Apex11 feels calm to run,

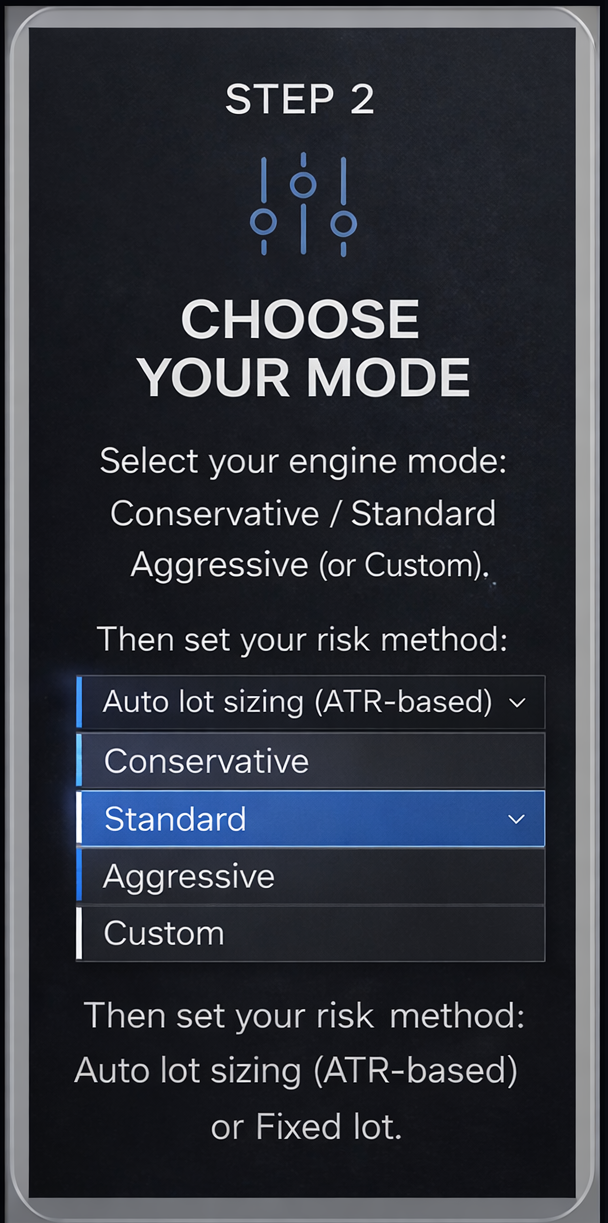

Choose Your Trading Mode.

Tailor your trading style to match your risk torlence.

Apex11 lets you choose how hard the engine pushes — Conservative, Standard, or Aggressive — while keeping execution risk-capped by design.

One trade at a time. No trade stacking. Risk-first execution.

Apex_Conservative → stricter conditions, lower exposure

Apex_Standard → balanced opportunity + protection

Apex_Aggressive → more opportunity, still risk-capped

No matter the mode, Apex11 doesn’t abandon discipline.

30 Day Money Back Guarantee

RISK & POSITION CONTROL

Gold doesn’t give second chances.

When it moves, it moves fast — and poor risk control is how good trades turn into bad days.

Apex11 was built with that reality in mind.

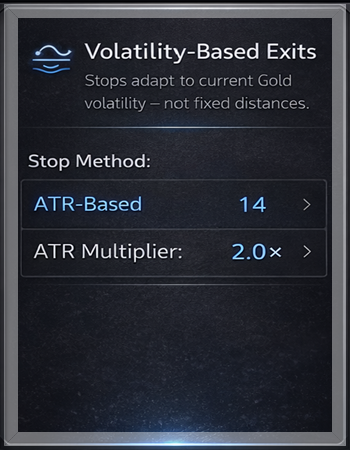

Instead of fixed, careless stops, Apex11 uses volatility-aware position sizing and exits that adapt to current market conditions.

Position size is calculated automatically based on your account balance and the stop distance — so risk stays consistent even when Gold volatility expands.

Stops are not guessed.

That means:

For traders who want more control, Apex11 also supports fixed lot sizing — but the philosophy stays the same:

Risk is planned first. Execution comes second.

OPTIONAL SCALING — DONE PROPERLY

Apex11 includes an optional scaling feature for experienced traders.

If enabled, scaling does not stack trades or layer positions.

It applies only on the next valid signal, using the same risk logic — not desperation entries and not “hope mode.”

You choose whether scaling is on.

THE GOAL IS SIMPLE

Protect capital during chaos.

That’s what professional risk control actually looks like.

APEX SMART MONEY MANAGEMENT SYSTEM

INSTITUTIONAL RISK CONTROL — BUILT TO LAST

Most retail EAs don’t blow up because the strategy is bad.

They blow up because they never know when to slow down.

High win-rate systems keep firing trade after trade…

Apex Smart Money Management was built to stop that.

Instead of blindly pressing size, Apex11 monitors its own performance in real time.

It doesn’t add risk.

So when the inevitable loss shows up, it’s controlled — not catastrophic.

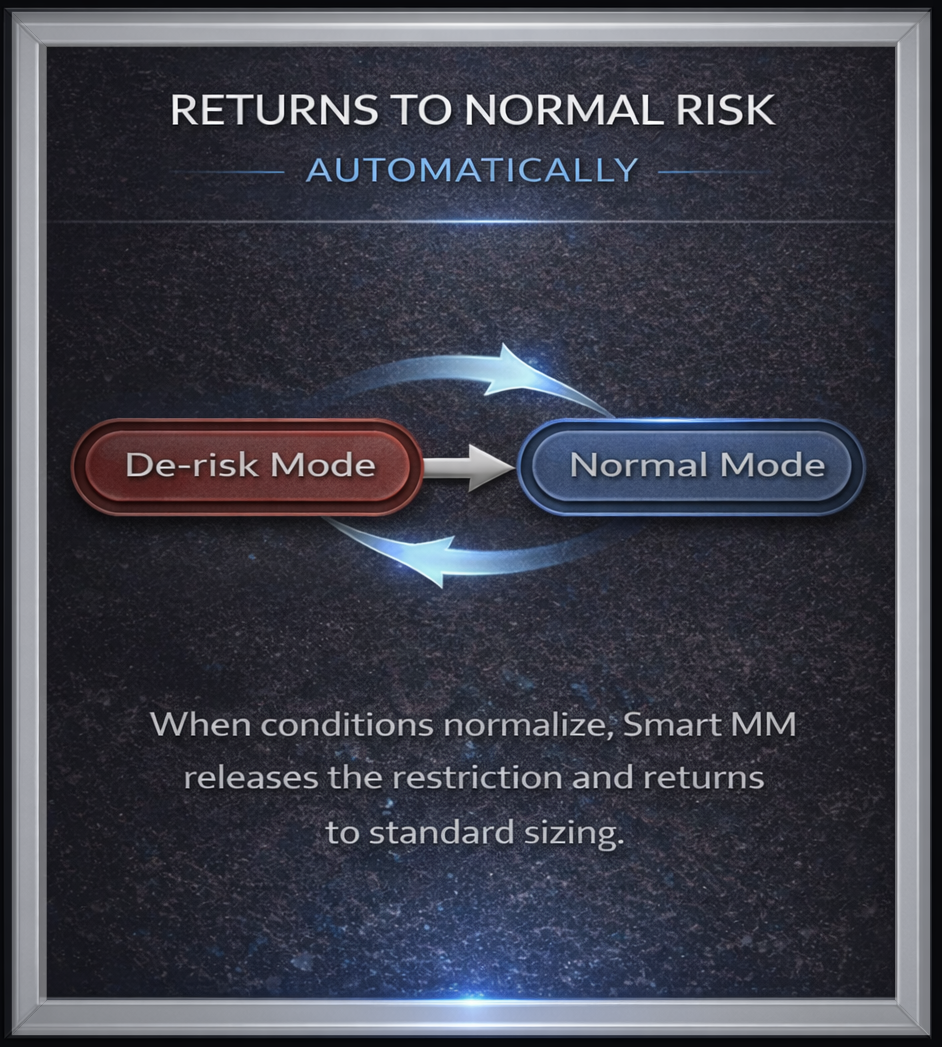

Once conditions reset, Apex11 automatically returns to normal position sizing and continues trading as designed.

The result isn’t flashy spikes.

That’s how professionals manage risk.

30 Day Money Back Guarantee

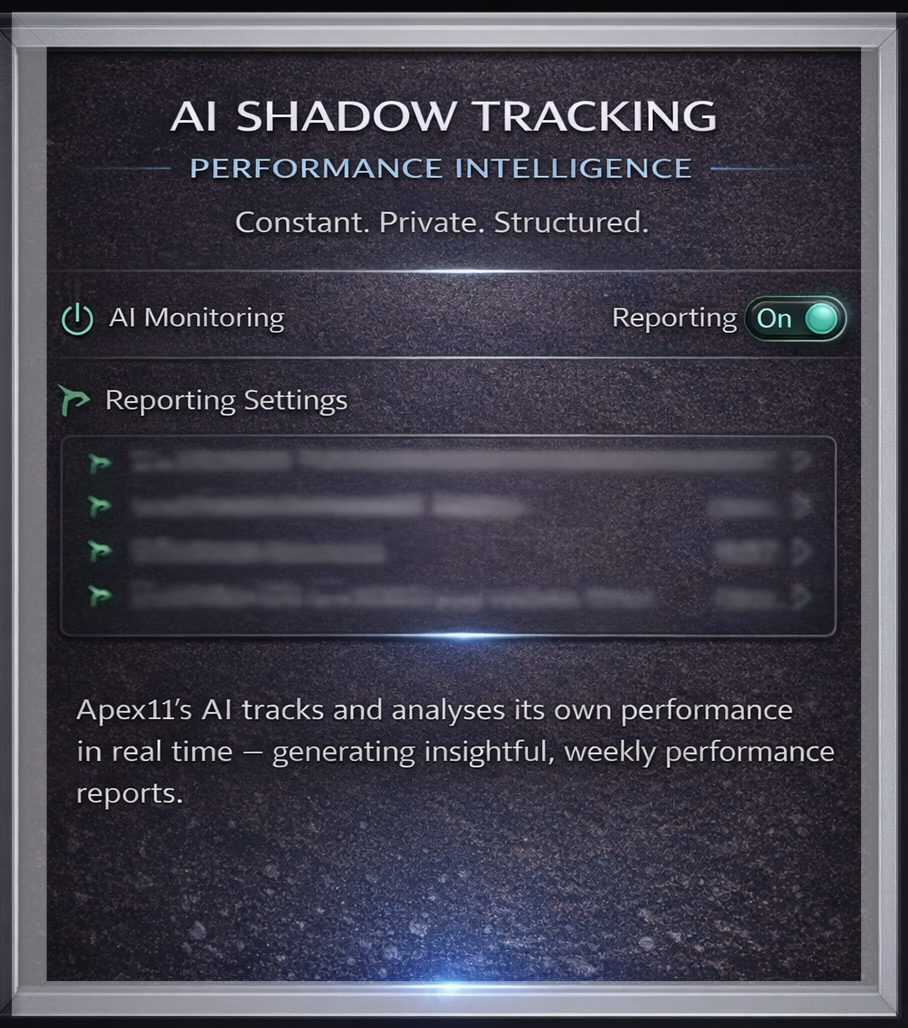

AI SHADOW TRACKING & WEEKLY PERFORMANCE ANALYTICS

THE SYSTEM WATCHES ITSELF — IN REAL TIME

WHY APEX11 DOESN’T DIE WHEN THE MARKET CHANGES

You’ve seen this before.

An EA works great for a while…

That happens because most systems trade blind.

Apex11 is different.

Behind the scenes, AI Shadow Tracking is constantly monitoring every single thing Apex11 does — every setup, every trade, every condition it trades under.

It tracks:

How trades behave hour by hour

How different risk modes are performing

How exits, scaling, and protection layers are interacting

How the system responds as market conditions evolve

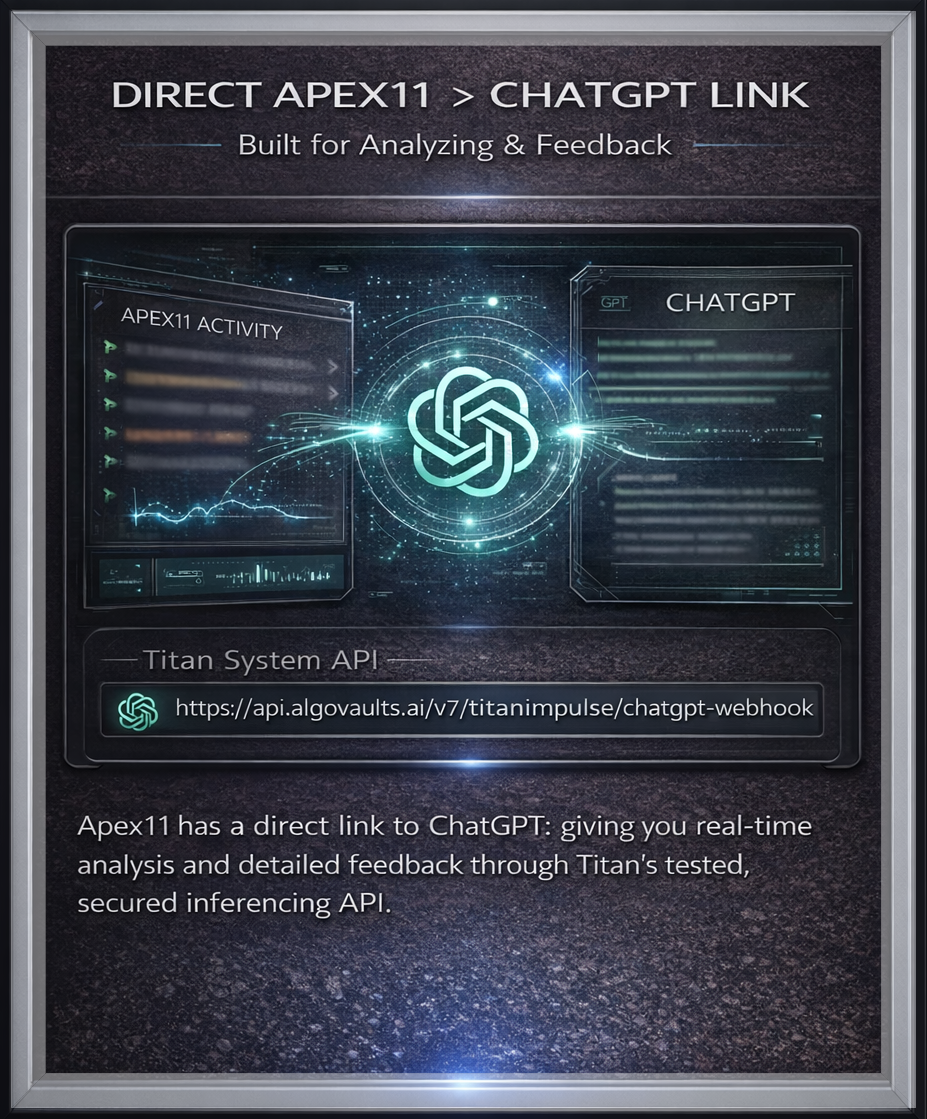

All of that intelligence is then fed into the AlgoVaults AI engine, where it’s analysed as a complete system — not just isolated trades.

Once a week, Apex11 produces a clear, downloadable performance report that shows:

Whether the current setup is still valid

If risk should be dialled up or down

If certain trading hours should be reduced, removed, or expanded

How the system is adapting to current market behaviour

This isn’t optimisation.

The system evolves with the market instead of being left behind by it.

That’s why Apex11 is built for longevity —

They don’t watch themselves.

30 Day Money Back Guarantee

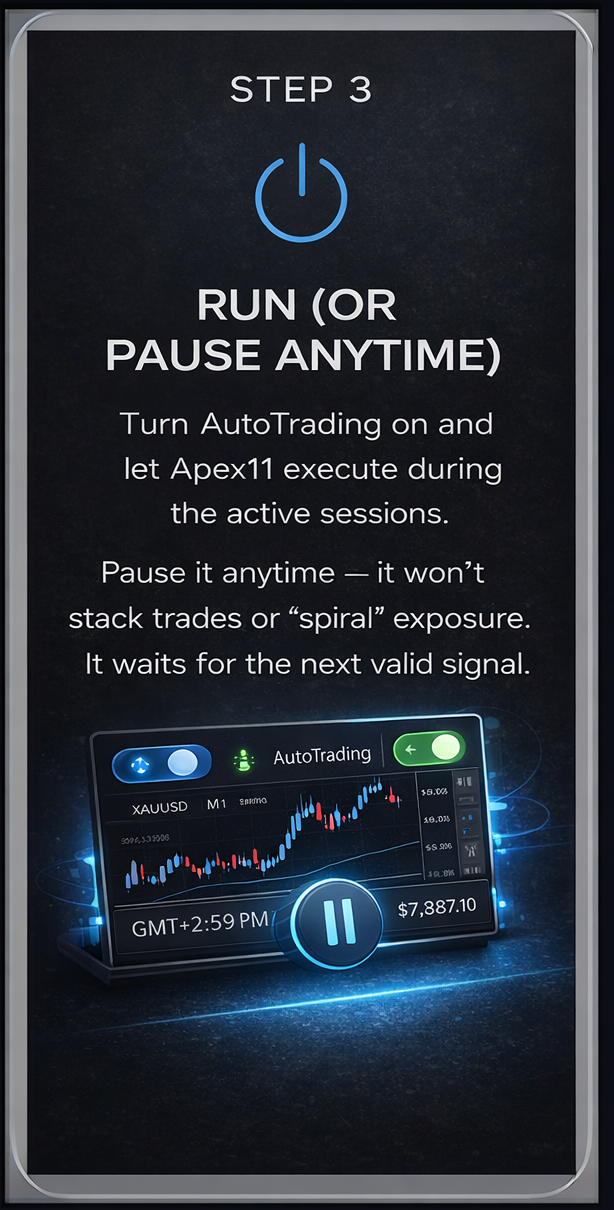

Apex11 Quick Start

Get it running in MT5, choose your risk mode, and let Apex11 Do The Rest.

One trade at a time. No grid. Built for disciplined Gold execution.

30 day Money Back Guarantee

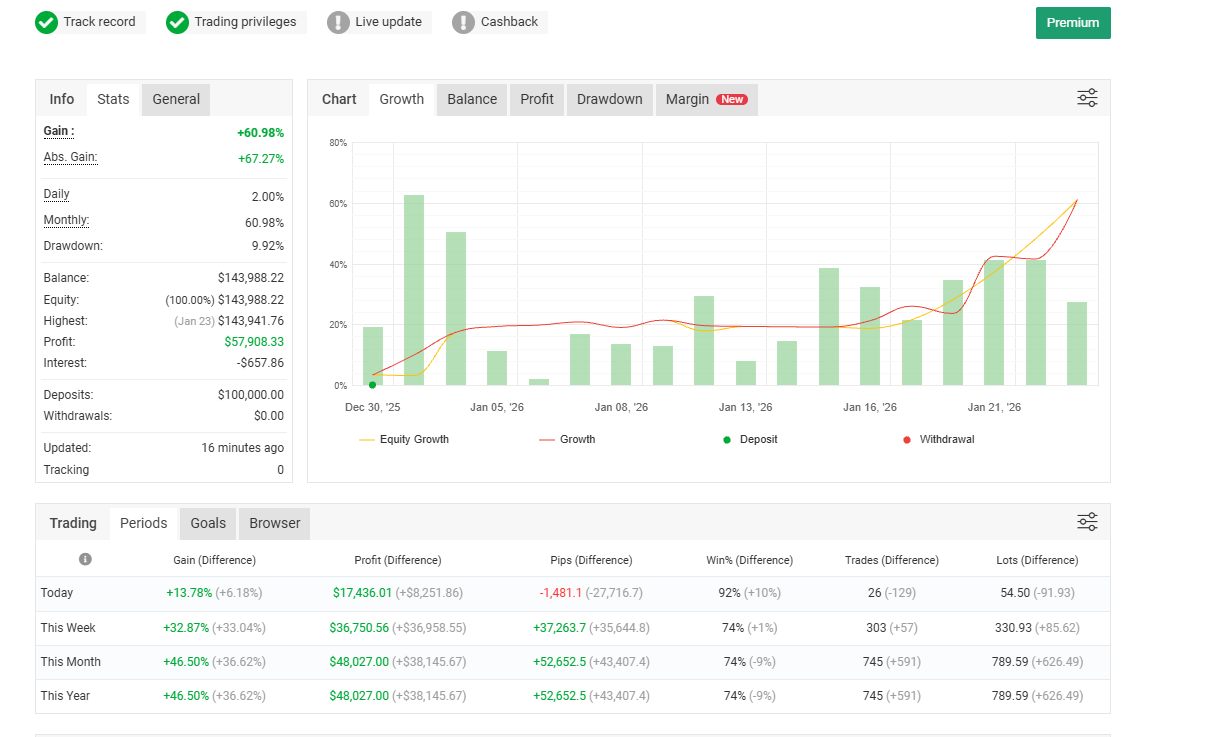

LIVE Funded Account — Tracked on Myfxbook

FAQ

No Guesswork. Here’s How It Works.

Q: Does it use martingale or grid?

A: No. Never.

Q: How many markets does it trade?

A: It is built for fast moving point based markets Gold (XAUUSD) US Indices and Silver.

Q: What broker/account type do I need?_

A: A broker that offers stable MT5 execution on XAUUSD, reasonable spreads, and reliable order fills. Standard/ECN-style accounts are typically preferred. If spreads are consistently wide, any EA will behave worse — that’s just reality.

Q: Is profit guaranteed?

A: No. There are no guaranteed profits. Trading is risky, especially with leveraged products. The purpose of the trial is to let you evaluate how the EA behaves: risk control, discipline, and execution in real conditions.

Q: What exactly is The Apex11 System?

A: Apex11 is a trend based intra-day scalping system designed for fast moving markets specially built for Gold.

Q: What timeframe does it run on?

A: 1 Min timeframe is recommended in the setup instructions you provide. The EA logic runs independently, but you should attach it exactly as instructed for consistent behavior.

Q: Do I need a VPS?

A: Not required, but recommended if you want continuous uptime (especially if you’re running the trial on a live account).

Q: Can I use it on a prop firm account?

A: Apex11 includes prop-style risk guardrails, but every prop firm has different rules. You’re responsible for ensuring the settings match the firm’s drawdown and trading conditions. The 7-day trial lets you validate behavior safely.

Q: Is it safe to run on a live account?

A: Start on demo if you’re unsure. If you run live, use conservative settings and risk you can afford. The system is built risk-first — but you control the account and the risk level.

Risk Disclaimer Important Risk Warning (Read This):

TitanImpulse AI is a software tool designed to assist with trade execution and risk controls. No guarantees are made regarding profitability, performance, or results. Past performance, backtests, hypothetical results, and examples (if shown) are not indicative of future results. Market conditions, spreads, slippage, latency, broker execution, and liquidity can materially impact outcomes.

You are solely responsible for your trading decisions, account settings, risk parameters, and compliance with any broker or prop-firm rules. Consider seeking independent financial advice if you are unsure whether leveraged trading is appropriate for you.

This website and software do not provide investment advice. Nothing on this page should be considered a recommendation to buy or sell any financial instrument.

© 2026 AlgoVaults.com — All Rights Reserved.

Need Help ?

support@algovaults.com